Contact

020 4515 6728

info@ccameron.co.uk

Charles Cameron & Associates

Blackfriars Foundry

154-156 Blackfriars Road

London SE1 8EN

About us

A later-life mortgage is a mortgage designed for homeowners aged 55 or over and allows you to borrow money based on the value of your home while continuing to live there. We advise on later-life mortgages, including Equity Release and Retirement Interest Only mortgages.

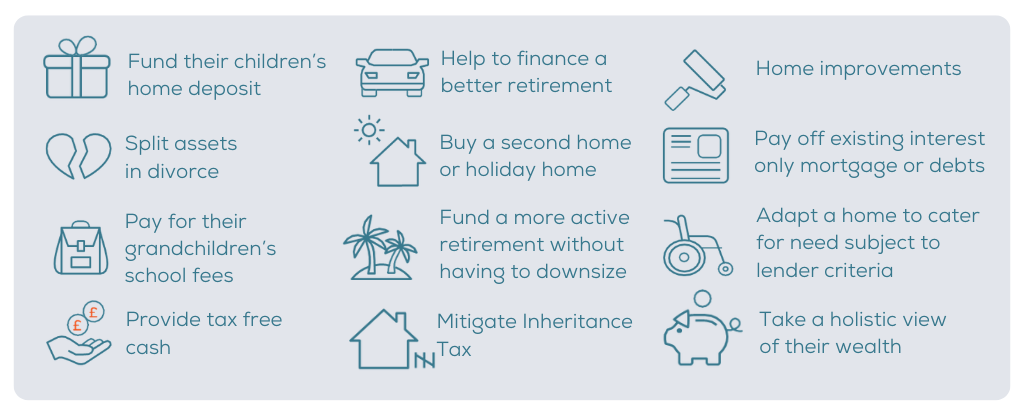

Typical reasons for requiring a later-life mortgage:

We are a proud member of the Equity Release Council.

Later Life Lending options

Retirement Interest Only Mortgage

A type of residential mortgage

A Retirement Interest Only Mortgage, RIO, is a loan secured against your property. With this type of mortgage, you will have to pay the interest every month, but the loan is usually paid off when you die, sell the property or move into long-term care. The total loan amount will not increase; you will only need to prove you can afford the monthly interest repayments.

KEY POINTS:

Usually lending up to 60% loan to value

55 years old in excess and up to 85 years old

Income assessed: based on pension and investment income, or a combination of both.

Lifetime Mortgages

A type of equity release

A lifetime mortgage is a loan secured against your property. It enables you to continue to own 100% of your home whilst also releasing either a lump sum of tax-free cash or a series of lump sums from the value of your property. The amount you can release depends on your age and the value of your property. You will not have to repay the loan until you die or move into long-term care.

KEY POINTS:

You need to be a homeowner aged 55 or over and UK resident

No monthly repayments

You can choose if you want to pay interest monthly or to roll it up

You retain 100% ownership of the property

An experienced team of mortgage experts

We have over 20 years’ experience to provide mortgage advice to all our clients.

Get In Touch

Benefits of our services

- Totally independent of any lender with access to the whole market

- Over 20 years of experience in the mortgage industry

- Dedicated Adviser & Mortgage Administrator

- Full application support

- As many meetings as you require

- Independent Advice

- Access to preferential rates unavailable direct from lenders

- Time, Stress and Money Savings